The downside of VC funding for biotech

World of DTC Marketing

JANUARY 24, 2022

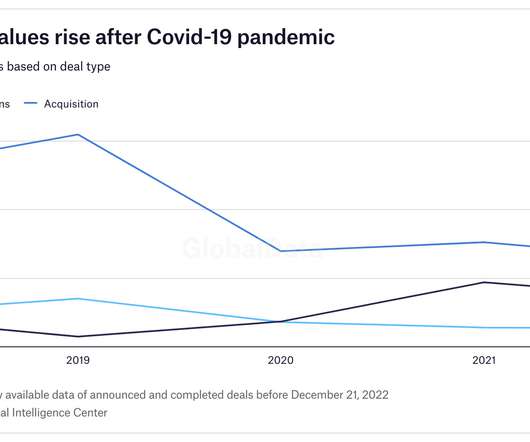

Venture capitalists have poured $42 billion into drug development over the past three years. Most small biotech companies rely on venture capitalist funding to develop new drugs but is that a good way to go? Venture capitalists often don’t look that far forward. not necessarily. Only about $2.2

Let's personalize your content