Does Your Sales Compensation Plan Really Pay for Performance?

April 6, 2021

The biopharma industry rightfully places a great deal of emphasis on the importance of having a sales compensation plan that pays for performance. However, paying for performance is a rather complex concept that can be both difficult to design—in terms of what level of pay-for-performance a plan should have—and difficult to measure—in terms of how to statistically determine whether a plan is paying for performance. Most consider a sales compensation plan to pay for performance if a sales representative who sells more gets paid more. However, this just scratches the surface of what it means to pay for performance; in fact, many equitable pharma sales compensation plans that are believed to pay for performance actually do not.

What Does it Actually Mean to Pay for Performance?

In order to truly pay for performance, a biopharma sales compensation plan must be designed such that it meets the following two attributes:

Sales representatives who achieve similar levels of performance are paid similar bonuses.

Sales representatives who achieve very different levels of performance are paid bonuses that reflect that difference.

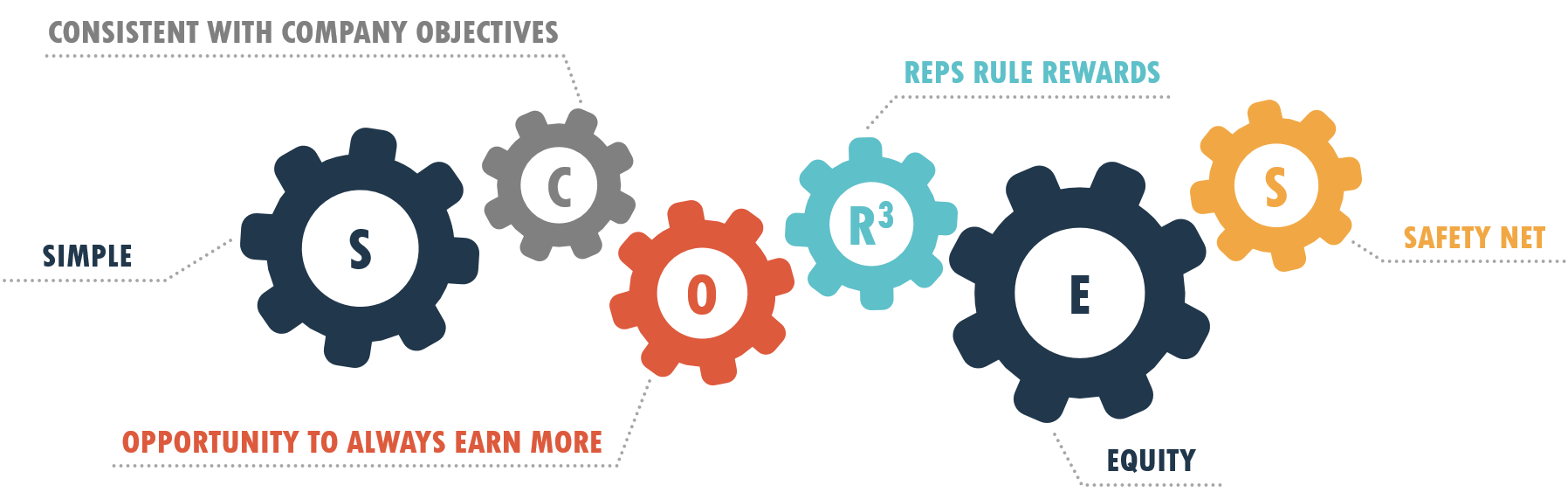

Though many sales compensation plans seem to pay for performance, it is when these two attributes are considered that it becomes clear that they indeed do not truly pay for performance. These two attributes are so critical to the motivating power of a sales compensation plan that one of the tests of equity of our SCOR³ES® diagnostic assessment is dedicated exclusively to these principles.

SCOR³ES® is an acronym for the six critical criteria a sales compensation plan must meet if it is to be truly effective and motivating. Each criterion is quantitatively evaluated on a scale of 1.0 to 5.0, where 3.0 is passable and any rating less than 3.0, on any criterion, means that the plan is in need of improvement and is not driving sales as well as it could be.

Equity is the most important among the six criteria, so much so that SCOR³ES® includes four patent-pending tests of equity. The pay-for-performance test of equity is just one of these tests and, together, these tests shed light into the degree to which a sales compensation plan is fair and equitable.

In order to further explore the concept of paying for performance, let’s investigate two common sales compensation plans that do not meet the two attributes discussed earlier.

Example 1: Rank Order Sales Compensation Plan

Consider a rank order sales compensation plan that pays on market share change over last quarter. Our top performer, Jeff, increases market share by 1.03 share points and receives a payout of $25,000. Our next best performer is Jane, who increases market share by 1.029 share points and receives a payout of $20,000.

How would this make Jane feel? She is paid $5,000 less than Jeff even though only an increase of only 0.001 share points separates the two of them. Jane would probably feel that the small difference in performance doesn’t justify the large difference in bonus—and she would be correct. This sales compensation plan, and many other rank order plans, fails the pay-for-performance test of equity.

Example 2: Goal-Based Sales Compensation Plan

For our next example, consider a goal-based sales compensation plan for a buy-and-bill product that can be inventoried. Sales representatives are compensated against the below payout curve, which accelerates payment above 100% attainment:

Pay Per

Attainment Point

From 80% to 100%

$375

From 100% onward

$1,000

This curve awards $2,500 at 80% attainment and then pays $375 per attainment point until 100%, after which the curve pays $1,000 per attainment point.

Now consider two sales representatives—Kate and Karl. Kate is a steady worker while Karl varies his level of engagement quarter to quarter. Below details their results over two quarters.

| Quarter 1 | Quarter 2 | Overall | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Attainment | Payout | Attainment | Payout | Attainment | Payout | ||||

| Karl | 90% | $6,250 | 106% | $16,000 | 98% | $22,250 | |||

| Kate | 100% | $10,000 | 100% | $10,000 | 100% | $20,000 | |||

Even though Karl’s attainment for two quarters is below 100%, he earns more than Kate even though Kate consistently earns 100% attainment each quarter. Despite her steady performance—and overall superior performance—Kate earns less than 90% of what Karl earns. Accelerating payout above 100% attainment is unfortunately a common pitfall in payout curve design and this plan would also fail our pay-for-performance test of equity¹.

These are just two examples of sales compensation plans that don’t pay for performance. Other characteristics of plans that frequently lead to challenges regarding pay for performance are setting goals based on a territory’s sales trend, tier-based grid plans and nearly all rank order plans.

Conclusion

When sales representatives do not feel that they are being correctly compensated for their performance, they become resentful and complacent. The sales compensation plan must be designed to energize and motivate the sales force to drive sales, and that cannot be achieved with a plan that does not pay for performance.

¹ Such results are especially possible in products that are inventoried because the sales representative can have the customers forward buy every other quarter. This would result in high volume followed by low volume quarter after quarter. Because of this, buy-and-bill products require special attention in the sales compensation plan design process to ensure that the sales force drives sales every quarter to the maximum amounts.