Traditionally, when pharma marketers and their strategy, creative, and media agencies develop marketing plans, investment recommendations tend to focus on HCPs, patients, and managed care. On the HCP side, marketers tend to allocate the bulk of their investment on medical doctors as, historically, they have been the primary prescribers.

However, as the shortage of MDs accelerates1 the makeup of the healthcare provider landscape has significantly changed, and the role of the nurse practitioner (NP) and physician assistant (PA) has grown in importance. Pharma marketers have begun to respond to this shift by allocating more of their promotional budgets to the NP/PA community.

In a recent survey completed by MM+M, nearly 28% of surveyed marketers claim they are increasing their NP/PA investment level.2 But why only 28%, given the growing role and economic impact of NP and PA clinicians? This article explores NPs/PAs and the opportunities available to engage them more fully as their role in our healthcare system continues to grow.

The Enormous and Growing Economic Impact of the NP/PA Prescriber

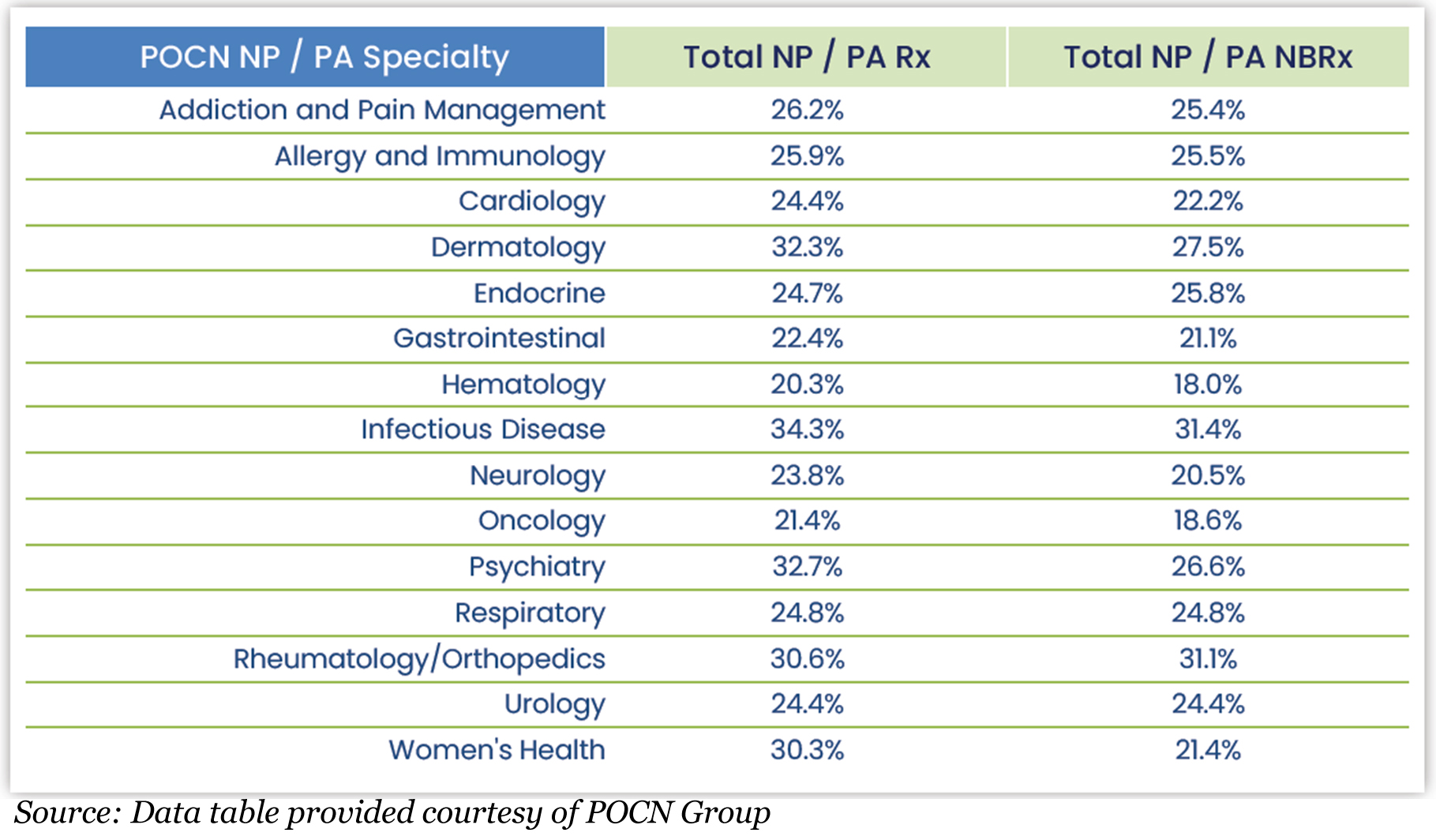

Today, NPs and PAs are authorized to prescribe in all 50 states and D.C. and comprise approximately one-third of all prescribers—almost 700,000 in total. NPs/PAs write approximately 1.4 billion scripts per year while 90% say they make patient treatment decisions autonomously. And these numbers are only growing as Nurse Practitioner is the “fastest-growing occupation in the U.S.”3

The American Association for Nurse Practitioners (AANP) reports that NPs write approximately 21 prescriptions per day on average, and nearly 60% see three or more patients per hour while the average PA sees 71 patients a week.4 Similarly, NPs and PAs are responsible for both new-to-brand (NBRx) and repeat scripts across all therapeutic areas.

The chart below summarizes the percentage of NP/PA RX and NBRx medications highlighting the penetration of NP/PA activity across a range of specialties.

Another important consideration is that NPs can now operate independently in 25 states and the District of Columbia with an MD.5 In some instances, they hire MDs thus flipping the paradigm on its head. These NPs tend to operate as primary care physician (PCP) practices and refer patients to specialists just like any PCP provider. Regarding PAs, the Academy of Physician Assistants (AAPA) identifies six states where PAs currently enjoy “full prescription authority”6 while an additional eight states are “considering expanding practitioners’ scope of service” rights.7

Reactions from the Healthcare System

The trend toward NPs and PAs taking on a larger role in healthcare delivery (i.e., working independently of MD physicians) is not without some controversy. Certain medical associations and groups are pushing back on the trend, while nursing organizations and others defend the practice. The American Medical Association (AMA) itself puts it more bluntly: “Patients deserve care led by physicians.”8

Meanwhile, the response on the other side can be heated. In that same article, the American Association of Nurse Anesthesiology provided its own statement: “As doctors fight scope-expansion bills, nursing professionals have said physicians are trying to protect their turf—and their higher salaries—at patients’ cost.” However, the rising shortage of PCPs, especially in rural communities9 shows no sign of slowing down. As a result, it’s unlikely the NP/PA community will have less of a role and impact in the foreseeable future.

Data Sources to Target and Reach the PA/NP audience

According to Deb Nevins, Chief Strategy Officer for POCN Group, an organization dedicated to supporting the NP/PA community (and one of The Stem network’s advisers), many marketers still don’t know that 99% of all NPs/PAs have NPI numbers and their prescribing activity can be easily tracked and measured.

While IQVIA, Symphony, Komodo, and other providers are popular sources of HCP data, specialized organizations, such as POCN, can apply additional filters, datasets, and proprietary algorithms to further drill down to actual or assumed individual NP/PA specialty based upon their individual prescribing behaviors to further refine and improve targeting and engagement.

NP/PA ROI Data and Recommended Investment Levels

Readily available data on expected ROI levels is lacking for when pharma invests marketing dollars targeting the NP/PA audience. However, according to Nevins, POCN has conducted script lift studies showing positive ROI rates ranging from 2:1 to 6:1. POCN’s guidance to pharma in terms of budgeting is that pharma should consider allocating promotional investment commensurate with the size of the NP/PA audience compared to the overall HCP audience. In other words, POCN recommends that approximately one-third of a pharma brand’s HCP marketing budget should be invested in the NP/PA audience.

Considerations for Engaging NPs/PAs

The NP/PA audience should be of interest to Medical Affairs teams as well as marketers because NPs and PAs are often the gate keepers of their practice and want to be educated on the latest clinical developments. They are continual learners and tend to give more time to visiting sales reps. Skewing younger, they are digital natives and responsive across a range of channels and tactics including search, social, email, endemic medical sites, advocacy organizations, digital video, podcasts, point of care, and more.

Bipan Singh, Sr. Marketing Director at UCB, agrees and shared for this article: “In busy practices, NPs/PAs are spending a lot more time with patients/caregivers than the physicians do and hence marketers must diversify their promotional spend to accommodate this segment.”

It’s important for pharma to understand the needs and wants of the NP/PA audience apart from the broader MD audience to intelligently tailor messaging and engagement tactics. For instance, while clinical data is important, NPs and PAs tend to be holistic treaters and want to be prepared to communicate how a new treatment might impact the lives of their patients. What is the efficacy? What are the side effects and lifestyle impacts? What is the history of adverse effects? Can their patients afford the medication, will it be covered, what is the economic impact? NPs and PAs want to hear the whole story inclusive of the scientific/clinical aspects.

Lastly, while it’s relatively easy to execute any given digital tactic, per Nevins, it’s critical that engagement strategies are continuous and based on real-world marketing data and insights. A one-off tactic is not going to generate desired outcomes and a real commitment to understanding and supporting these clinicians is crucial to success.

Implications and Next Steps

The implications for pharma brand and Medical Affairs teams are clear: conducting research and refining marketing practices to understand, reach, and engage the NP/PA community is a critical aspect of HCP engagement. As you embark on your brand planning this year ask yourself the following:

- Do you feel that you understand the NP/PA audience relevant to both your therapeutic category and your specific brand?

- Do you have a way to project their potential economic impact by examining changes to NRx and total prescription (TRx) volumes?

- Have you segmented and profiled your NP/PA audience and developed an engagement plan for ongoing and systemized outreach efforts both for non-personal and in-person marketing and sales efforts?

- Have you studied the metrics that would determine an appropriate budget including ROI?

- Have you defined the most impactful key performance indicators (KPIs) for data analytics measurement and reporting?

- Are you clear on the most impactful messaging, channels, and tactics to reach and engage your NP/PA audience?

If you answer no to any of these questions, it may be time to conduct an opportunity assessment including financials, strategies, and tactics. Your audience is hiding in plain view and now’s the time to develop an effective engagement plan.

References:

1. A report released by the Association of American Medical Colleges (AAMC) projects a shortage of between 17,800 and 48,000 primary care physicians by 2034.

3. https://nursejournal.org/articles/nurse-practitioners-fastest-growing-occupation-2022.

5. https://online.maryville.edu/nursing-degrees/np/resources/states-granting-np-full-practice-authority.

8. https://www.washingtonpost.com/health/2023/08/20/nurse-doctor-scope-medical-titles.