Considerations for Maintaining Payer Network Access in the World of Vertical Integration – Part 2: Abusive PBM Practices and Tools for Providers to Combat Them

An overview of the legal and business tools available to community, specialty, hospital, and health-system pharmacies in seeking to maintain payer network access and combat abusive practices.

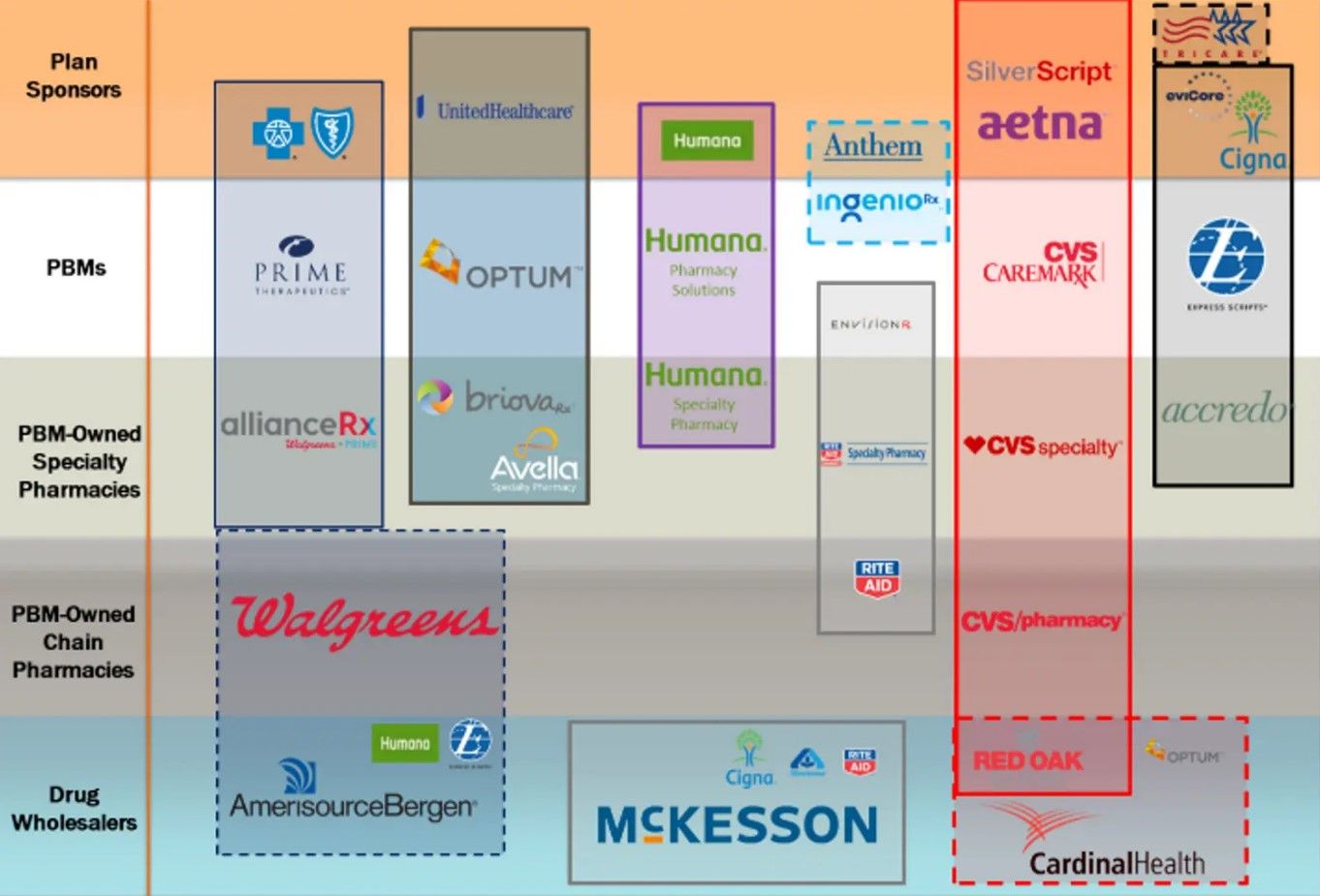

In part 1 of this series, titled “Considerations for Maintaining Payer Network Access in the World of Vertical Integration – Part 1: The Pharmacy Benefits Landscape” we discussed in detail the current pharmacy benefits landscape and provided a brief history of how they came to dominate more than 80% of the US pharmaceutical industry through vertical integration (Figure).

In this second and final part of the series, we continue our discussion with the abusive pharmacy benefit manager (PBM) practices that have stemmed therefrom, as well as the legal and business tools available to community, specialty, hospital, and health-system pharmacies in seeking to maintain payer network access and combat abusive practices.

Abusive PBM Practices

With such concentration and integration among PBMs comes great leverage, and in turn, great opportunity for abuse. While tomes could be—and have been written—about the variety and length of various PBM abuses, detailed below are several recent abusive tactics and trends employed by PBMs and felt by independent pharmacy providers, including hospital and health-system pharmacies.

Below-Water Reimbursement Rates

As part of their one-sided “take-it-or-leave-it” contracts, PBMs typically retain the ability to update their terms unilaterally with very little notice. PBMs routinely use these provisions to foist aberrantly low reimbursement rates on pharmacies, often causing pharmacies to lose money on prescriptions.

This is particularly harmful for pharmacies dispensing specialty medications, for which such below acquisition cost reimbursement can cause pharmacies to lose $500 or more on a single fill. This has broad ramifications for both pharmacies and patients.

Direct and Indirect Remuneration (DIR) Fees

Another reimbursement tactic that has been broadly used by PBMs, particularly regarding Medicare Part D plans, is DIR fees, which is the catch-all term to describe post point-of-sale recoupments from pharmacies by PBMs. Sometimes referred to as “performance variable rate” or “network rebates,” DIR fees are typically assessed either as a fixed dollar amount or a percentage of the adjudicated amounts—often ranging between 3% and 11% of the claim. Because they are often assessed months later, it can become extremely difficult for pharmacies to properly accrue for their true exposure.

Worse yet, although most DIR fee programs are ostensibly tied to pharmacy performance, many programs do not have appropriate metrics relevant to specialty pharmacies. Thus, these providers often find themselves without any possibility of an upturn or ability to improve their DIR fee score.

Generic Effective Rates (GER)

In the commercial space, GER have taken over as the latest PBM tactic to squeeze money out of pharmacies through post point-of-sale reconciliations. In contracts containing GER provisions, PBMs will reimburse pharmacies at the point-of-sale based on traditional pricing methodologies, i.e., contractual discount off average wholesale price (AWP) or maximum allowable cost (MAC).

Months later, however, PBMs will assess the total AWP discount on all generics dispensed by a particular network—such as a pharmacy services administration organization’s (PSAO) pharmacies—and will seek to “true up” to that contractual effective rate. For example, a PBM may impose a GER contract on a particular PSAO with a GER of AWP minus 83%.

Over the course of the contract term, the PSAO’s pharmacies may be reimbursed a range of amounts, some that are higher than the GER rate, as is the case of single-source generics, and some that are lower than the GER rate, as is the case of multisource generics for which there is an aggressive MAC price. If at the end of the contractual period, the average effective rate for generics dispensed by the PSAO’s pharmacies was, for example, AWP minus 80%, the PBM would institute a GER reconciliation and require the PSAO to “true up” the 3% difference to the PBM.

PSAOs, in turn, would typically pass this reconciliation on to their member pharmacies. These GERs, or brand effective rates when applied to brand drugs, have resulted in hundreds of thousands of dollars in clawbacks from pharmacies. These are frequently applied without any real advance notice, and many times have caused net reimbursements to drop below the acquisition costs for the products at issue.

Prescription Trolling/Patient Slamming

Aside from affecting the profitability of independent pharmacies when filling many prescriptions, PBMs engage in outright efforts to siphon off or redirect prescriptions to their wholly owned pharmacies. These types of underhanded efforts have come in many forms, sometimes referred to as “prescription trolling” or “patient slamming.” In a common scenario, a pharmacy may receive a prescription for a high-priced specialty medication.

When the pharmacy goes to submit the claim for reimbursement, it will receive a reject message saying that the prescription requires a prior authorization. The pharmacy will then engage in the laborious process of coordinating with the prescriber’s office to ensure that all required information is gathered and submitted properly.

Once this information is submitted and the prior authorization is approved, the PBM will share the information with its wholly owned specialty pharmacy, which will then contact the prescriber or the patient seeking to compel the prescription to be transferred to their wholly owned pharmacy. In other, more egregious instances, PBM-owned pharmacies have simply unilaterally filled the prescriptions without the knowledge or consent of the patient, prescriber, or original pharmacy.

The pharmacy may then discover this conduct when they resubmit the claim only to learn that the prescription has already been filled by the PBM-owned pharmacy.

Restrictive Payer Networks

A final abusive PBM tactic aimed at further increasing a monopolistic hold on the drug channel is the use restrictive PBM networks. PBMs accomplish this through various means.

For example, PBMs may impose severe limitations on the ability of independent pharmacies to mail or deliver medications to their patients. In the age of Amazon, FreshDirect, and DoorDash, patients are increasingly coming to expect the convenience of direct-to-home delivery of all products. These limitations put independent pharmacies at a severe competitive disadvantage compared to PBM-owned mail order pharmacies.

Another tactic being increasingly used in the context of infused drugs is the use of step therapy requirements on Part B drugs that would otherwise be administered in-office and billed under a medical benefit. Instead, PBMs first require the use of a Part D drug billed under the pharmacy benefit and dispensed by a PBM-owned pharmacy.

As a final tactic to keep independent providers out of network, PBMs have continually employed unreasonable barriers to network entry. This has included requirements of several different forms of accreditation, universal pharmacy licensure, or excessive amounts of liability insurance.

Each of these terms and conditions are required more for purposes of restricting network access and less for the purposes of improving overall levels of care within a network.

Tools Available to Providers to Maintain Payer Network Access

While the average independent pharmacy reader may reasonably feel somewhat dejected at this point, fortunately, there are several tools and laws that help to protect independent pharmacies’ operations and patients’ access to quality care.

Accreditation and Strategies for Network Entry

First and foremost, any independent pharmacy provider, including hospital and health-system pharmacies, must have a clear strategy in place to ensure their participation in PBM networks. This involves first identifying the most appropriate networks based on their pharmacy type (i.e., retail, specialty, long-term care, home infusion, compounding, mail order, etc).

From there, it requires being fully abreast of the applicable terms and conditions for the given network(s) and having a dedicated team to ensure that it can meet and remain compliant with these requirements. Part and parcel to this is the importance of seeking out third-party accreditation, where appropriate, to aid in validating existing practices.

It also requires working with experienced consultants, advisors, and counsel to help navigate the complex web of payer contracts and credentialing processes.

Federal Any Willing Provider Law

While preparedness is critical, knowledge of legal tools is equally important. One of the strongest legal tools available to independent providers is the Federal Any Willing Provider Law [42 U.S.C. § 1395w-104(b)(1)(A)].

The Federal Any Willing Provider Law governs the Medicare Part D program and provides that a Medicare Part D plan sponsor, “shall permit the participation of any pharmacy that meets the terms and conditions under the plan.” Guidance from CMS has expounded on this requirement, and directed that terms and conditions be both “reasonable” and “relevant.”

CMS has even gone so far as to state that paying below acquisition costs for a specialty drug is not a reasonable term and condition. Thus, this law can be used by pharmacy providers not only to require that PBMs give them the opportunity to seek participation in a given network, but to be reimbursed based on reasonable and relevant terms and conditions.

State Any Willing Provider Laws

Similar to the federal counterpart, nearly 30 states have some form of an “any willing provider” law on their books. These laws range in terms of their scope and reach, but many follow a similar framework requiring PBMs to allow participation of any pharmacy “willing and able” to participate on terms and conditions applicable to other participating pharmacies.

Because these laws are enacted at a state level and are typically written into the insurance code, they will generally apply to commercial health insurance plans issued in that state. In several states, they have been written into Medicaid codes as well, requiring PBMs to allow for participation in managed Medicaid networks. It is important that independent pharmacy providers be well-versed in these laws and are sure to assert their rights when necessary.

Patient Freedom of Choice Laws

If there was another side to the any willing provider coin, it would be the Patient Freedom of Choice Laws. These laws, which exist both at the federal level and within many states’ laws, act to provide patients with the right to choose a pharmacy of their choice. These laws can serve as a strong tool to allow patients to continue to receive their medications from their independent pharmacy despite the abusive PBM tactics described above.

Anti-Clawback Legislation

In addition to laws safeguarding network participation, in the past few years, several states have begun to pass laws prohibiting post point-of-sale reimbursement adjustments or clawbacks. Although these laws are unlikely to have any impact on DIR fees imposed under Medicare Part D plans, as those are regulated by federal law, they may serve to limit the ability of PBMs to impose onerous GER reconciliations and adjustments.

Compliance Programs to Avoid Network Terminations

The final necessary tool available to independent pharmacies is that of compliance. With the tenuous bargaining position independent pharmacies hold against the massive PBM conglomerates as discussed above, it is extremely important that pharmacies take every precaution not to give PBMs a “reason” to remove them from network.

This includes developing robust policies and procedures aimed at concepts such as co-payment collection, prior authorizations, prescription validation, delivery confirmation, and more. It is critical that independent providers work with experienced consultants and legal counsel to create policies that are unique to each pharmacy, and that such providers actively invest in monitoring and documenting their compliance with these policies in place.

Conclusion

To continue to be able to serve their patients, pharmacy providers of all types must continue to stay one step ahead and understand the range of options available to them. Experienced counsel can assist pharmacies in asserting these rights and maintaining leverage against the imbalance of power created by vertical and horizontal consolidation in the payer space.

About the Author

Jesse C. Dresser, Esq, is a partner in Frier Levitt’s Life Sciences Department and heads the firm’s Pharmacy Practice Group.