As pharma moves along on its journey towards an omnichannel, CX-driven future, measuring the customer experience (CX) is a vital way of assessing its progress. Knowing the extent to which stakeholders are delighted by their engagement with the industry provides a solid understanding of how different types of content, and the channels through which they’re delivered, are performing.

But our latest research shows the customer experience provided to HCPs in the US is approaching an inflection point, as unsustainable marketing investment choices face a looming reckoning. All too often pharmaceutical companies spend money on financing commercial activities for their own sake, and it’s unsustainable.

We’ve been tracking pharma’s progress in customer experience since 2017, using our Customer Experience Quotient® (CXQ®) to measure interactions between healthcare professionals (HCPs) and the pharmaceutical industry. These surveys see respondents asked about their two most-recent interactions with a pharma company and last year it was run for the first time on a global basis. Between July and September 6,270 HCPs in 14 countries rated a total of 12,540 recent experiences with a pharma company.

Our latest report, ‘The State Of Customer Experience In The US Pharmaceutical Industry, 2022: HCP Interactions’, is drawn from that research and features insights from 900 HCPs in the US who had a total of 1,800 interactions with pharma firms. The results show the current state of the customer experiences that pharma companies provide to HCPs in the US, how digital and non-digital channels compare, and how CX differs in some of the industry’s most important therapy areas.

The state of the pharma customer experience in the US

Globally, there was a post-COVID recovery in the levels of CX that pharma provides HCPs and the US rode this wave. During the massive upheaval of the pandemic and the rapid changes that pharma had to make to its marketing mix, the CXQ® score for the US sat at 53 – perilously close to a fair ranking. Moving into 2022, US healthcare professionals still had good customer experiences overall, but the industry enjoyed a much more solid score CXQ® for its engagement overall, with the return of face-to-face channels boosting it to 64.

Nevertheless, this still means the industry is some distance away from being able to deliver the excellent experiences that HCPs should receive and provides plenty of room for all companies to improve. Our research shows that delivering a good CX is table stakes, whereas excellent CX – scenarios where companies exceed customer expectations – is the area where key business drivers can really play in a company’s favour to generate an advantage over its competitors. But, in order to do that companies will need to optimise the content they provide and the channels through which it is provided.

Looking at US pharma’s use of channels, some clear trends emerge from the research. Despite the industry being in its third decade of using digital technology, it’s often missing the mark and digital channels continue to trail non-digital engagement. Non-digital channels, including face-to-face meetings with sales and medical reps, had a collective four-point advantage over digital channels in 2021 and that was extended slightly to five points in 2022. As with the overall CXQ® score for the US, the performance of both non-digital (65) and digital channels (60) in 2022 was solid but less than stellar.

Looking at channel performance in more detail we found that sales reps using technology provided the best CX in the US, with their use of video calls outperforming all other channels. Its CXQ® of 72 put it within striking distance of a coveted excellent score. Furthermore, sales rep engagements in the US were the three channels that provided the best CX. In this it should be noted that HCPs in the US bucked the general global trend for educational channels and content, specifically that provided by medical science liaisons (MSLs), to be ranked higher than their more commercial equivalents. Whether or not that speaks to an underinvestment in MSLs, and requires an adjustment to the rep mix, remains to be seen.

For now, it’s commercial not medical engagement that dominates. In our 2022 US survey in-person HCP visits by sales reps accounted for a huge 45% of all interactions. More generally, non-digital channels are still the mainstay of pharma engagement in the majority of the countries in our survey. Not only is the US no exception to this, but it also had one of the highest proportions of non-digital engagement.

But, although digital channels remain in the minority, their use is increasing. The HCPs we surveyed told us that 33% of their most recent interactions with the industry involved digital channels. While this is slightly up from 29% in 2021, the much vaunted ‘pivot to digital’ has been slow to take effect on the marketing mix in the US.

Close race for CX leadership in US

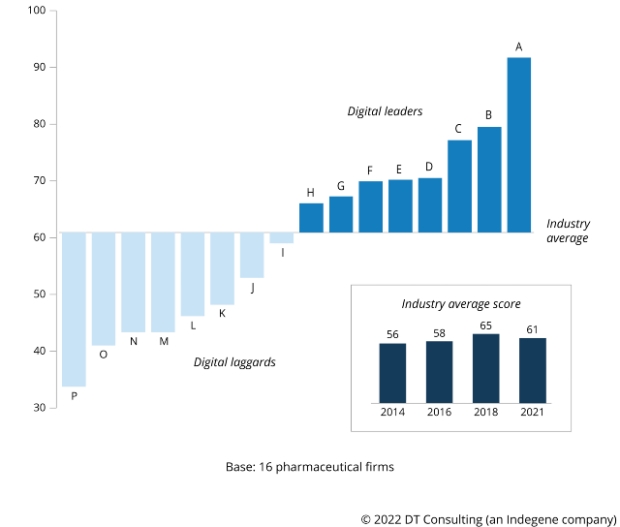

While industry performance in CX is only average, our latest study does show that when the data is broken down for a company ranking, there are a few pharma firms that are approaching excellence but no obvious frontrunner.

The three leading companies in our US benchmark were Janssen, Merck & Co, and Novo Nordisk and, with their respective CXQ® scores of 72, 71, and 70, they had the narrowest possible margin between them. The close competition between those companies hides trending data from our 2021 survey that adds a further element to the picture. Janssen and Merck & Co were able to ride the wave of the post-COVID CX recovery that was seen across much of the industry, whereas Novo Nordisk didn’t see any year-on-year progress with its score.

Refining the company rankings to focus on firms’ use of non-digital channels alone, we saw that Janssen’s use of channels like in-person events and face-to-face engagement with sales reps enabled it to do what no other firm could: attain CX excellence. Its CXQ® of 76 was boosted by particularly high scores for relevance and the simplicity of access to its content. Hot on its heels and within striking distance of that coveted ranking was Novo Nordisk, with a nearly excellent CXQ® of 74 in non-digital channels. Novartis’ CXQ® of 71 rounded out the three top-performing firms.

The CXQÒ rankings focus on HCP judgements about the relevance, simplicity, and trustworthiness of the content (whether information or services) that they receive or look for themselves. To delve deeper into the issue of relevance, the 2022 study included for the first time a question about personalisation. Seeking HCPs’ perceptions on how well an interaction had been personalised to their needs we found that excellence in personalisation is certainly possible, but that it remains a challenge for most companies.

Content challenges for pharma

The reliance on face-to-face channels already mentioned is also providing some challenges for the industry in terms of the content it provides. With the effectiveness of content an increasingly important area to focus on for companies looking for omnichannel success, the content gaps and underperformances we found need to be carefully considered.

Notably, prescription and dosage information is struggling to meet HCPs’ needs. Despite being one of the most commonly received types of pharma content, it only received a CXQ® score of 57 and suffered from a digital deficit. The CXQ® score of prescription and dosage information in non-digital channels is 62, was significantly higher than the CXQ® score of 51 when this information is provided via digital channels.

In contrast, digital delivery was found to improve the level of CX provided by clinical trial information, which gets a nearly excellent CXQ® score of 72 when provided via digital channels, compared with just 63 for non-digital delivery. HCPs also got slightly better experiences when accessing samples via digital channels – speaking perhaps to the more transactional nature of that type of interaction.

Prioritising customer needs

To be successful at omnichannel, pharmaceutical companies must right-channel the right content to the right customer, but as our CXQ® studies show, achieving this on a consistent basis to satisfy HCP expectations is an on-going challenge.

The potential is there for a wider, more effective use of digital channels, but they won’t be a silver bullet that will optimise the experiences that HCPs want from pharma companies’ people, information, and services. Indeed, making any generalisations when it comes to across channels and content types might serve to keep marketing budgets in check but they will be poor at meeting customer expectations. Instead, pharma’s commercial teams must, in almost every scenario, view customer experience excellence through the lens of meeting and then exceeding customer expectations.

• This article first appeared in the June 2023 issue of Med Ad News